MOUNTAIN VIEW, Calif., Feb. 13, 2019 /PRNewswire/ — CEVA, Inc. (NASDAQ: CEVA), the leading licensor of signal processing platforms and artificial intelligence processors for smarter, connected devices, today announced its financial results for the fourth quarter and year ended December 31, 2018.

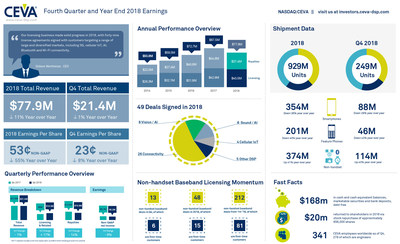

Total revenue for the fourth quarter of 2018 was $21.4 million, a decrease of 1%, when compared to $21.6 million reported for the fourth quarter of 2017. Fourth quarter 2018 licensing and related revenue was $10.5 million, an increase of 17%, when compared to $9.0 million reported for the same quarter a year ago. Royalty revenue for the fourth quarter of 2018 was $10.9 million, a decrease of 14%, when compared to $12.6 million reported for the fourth quarter of 2017, which period included a $0.9 million royalty catch up following an audit of a customer.

Gideon Wertheizer, Chief Executive Officer of CEVA, stated: "We had an excellent fourth quarter in terms of licensing with thirteen agreements signed, including a number of strategic agreements with premier customers. Notably, one agreement with a company targeting the 5G market was one of the largest signed in the company’s history. Our fourth quarter royalties came in lower than expected, reflecting softness at a large smartphone OEM, primarily due to the slowing economy in China and lower overall demand for entry-level phones in emerging markets."

Mr. Wertheizer continued: "Our licensing business made solid progress in 2018, with forty nine license agreements signed with customers targeting a range of large and diversified markets, including 5G, cellular IoT, AI, Bluetooth and Wi-Fi connectivity. These new agreements, along with the more than one hundred and forty signed in the previous three years, form the foundation for significant market share expansion and royalty revenue growth in the coming years. Our 2018 royalty business was impacted by the headwinds in the handset market and the slower than originally anticipated expansion at our base station customers. Nevertheless, we continued to strengthen our footprint in our non-baseband markets, with shipments of more than 370 million devices, up 41% year over year. In particular, in the fast-growing Bluetooth space, we shipped in more than 300 million devices in 2018, and are excited by the growth opportunity as that market is expected to exceed 5 billion devices annually by 2022. As we enter 2019, we expect the elevated inventories in handsets to add to the usual seasonal weakness in our near-term royalties. With that said, we do expect continued expansion at our non-handset and base station customers, along with a recovery in handsets in the later part of the year. All in all, we are very excited by the market adoption of our leading-edge technologies in key growth areas, and believe we are on track to more than double our royalty revenue business in 2022."

During the quarter, CEVA completed thirteen license agreements. Seven of the agreements were for CEVA DSP and AI platforms, and six were for CEVA connectivity IPs. All of the licensing agreements signed during the quarter were for non-handset baseband applications and six were with first-time customers of CEVA. Customers’ target markets for the licenses include 5G baseband processing, cellular IoT connectivity, advanced consumer and surveillance cameras, automotive connectivity, smart speakers, Bluetooth earbuds, Wi-Fi routers and other IoT devices. Geographically, nine of the deals signed were in China, two were in the U.S., and two were in the APAC region, including Japan.

GAAP net income for the fourth quarter of 2018 decreased 27% to $2.3 million, compared to $3.2 million reported for the same period in 2017. GAAP diluted earnings per share for the fourth quarter of 2018 decreased 29%, to $0.10 from $0.14 a year ago.

Non-GAAP net income and diluted earnings per share for the fourth quarter of 2018 were $5.2 million and $0.23, respectively, representing a 9% and 8% decrease, respectively, over the $5.7 million and $0.25 reported for the fourth quarter of 2017. Non-GAAP net income and diluted earnings per share for the fourth quarter of 2018 excluded: (a) equity-based compensation expense, net of taxes, of $2.0 million, (b) the impact of the amortization of acquired intangibles of $0.3 million associated with the acquisition of RivieraWaves and NB-IoT technologies, and (c) revaluation of investment in other company, net of taxes, of $0.7 million. Net income and diluted earnings per share for the fourth quarter of 2017 excluded: (a) equity-based compensation expense, net of taxes, of $2.3 million, and (b) the impact of the amortization of acquired intangibles of $0.3 million associated with the acquisition of RivieraWaves.

Full Year 2018 Review

Total revenue for 2018 was $77.9 million, a decrease of 11%, when compared to $87.5 million reported for 2017. Licensing and related revenue for 2018 was $40.4 million a decrease of 6%, when compared to $42.9 million reported for 2017. Royalty revenue for 2018 was $37.4 million, representing a decrease of 16%, as compared to $44.6 million reported for 2017.

U.S. GAAP net income and diluted net income per share for 2018 were $0.6 million and $0.03, respectively, a decrease of 97% and 96%, respectively, compared to $17.0 million and $0.75, respectively reported for 2017.

Non-GAAP net income and diluted earnings per share for 2018 were $12.1 million and $0.53, respectively, also representing a decrease of 54% and 55%, respectively, over $26.6 million and $1.17 reported for 2017. Non-GAAP net income and diluted earnings per share for 2018 excluded (a) equity-based compensation expense, net of taxes, of $9.7 million, (b) the impact of the amortization of acquired intangibles of $1.2 million associated with the acquisition of RivieraWaves and NB-IoT technologies, and (c) revaluation of investment in other company, net of taxes of $0.7 million. Non-GAAP net income and diluted earnings per share for 2017 excluded (a) equity-based compensation expense, net of taxes, of $8.4 million, and (b) the impact of the amortization of acquired intangibles of $1.2 million associated with the acquisition of RivieraWaves.

Yaniv Arieli, Chief Financial Officer of CEVA, stated: "In 2018, we continued to execute on our stock buyback program in the fourth quarter, purchasing approximately 129,000 shares of our common stock for an aggregate consideration of approximately $3 million. This brought our total stock repurchase for the year to approximately 656,000 shares for approximately $20 million. As of December 31, 2018, our cash and cash equivalent balances, marketable securities and bank deposits totaled $168 million, with no debt."

CEVA Conference Call

On February 13, 2019 CEVA management will conduct a conference call at 8:30 a.m. Eastern Time to discuss the operating performance for the quarter.

The conference call will be available via the following dial in numbers:

- U.S. Participants: Dial 1-844-435-0316 (Access Code: CEVA)

- International Participants: Dial +1-412-317-6365 (Access Code: CEVA)

The conference call will also be available live via webcast at the following link: https://www.webcaster4.com/Webcast/Page/984/28990. Please go to the web site at least fifteen minutes prior to the call to register, download and install any necessary audio software.

For those who cannot access the live broadcast, a replay will be available by dialing +1-877-344-7529 or +1-412-317-0088 (access code: 10127731) from one hour after the end of the call until 9:00 a.m. (Eastern Time) on February 20, 2019. The replay will also be available at CEVA’s web site ceva-dsp.com.

About CEVA, Inc.

CEVA is the leading licensor of signal processing platforms and artificial intelligence processors for a smarter, connected world. We partner with semiconductor companies and OEMs worldwide to create power-efficient, intelligent and connected devices for a range of end markets, including mobile, consumer, automotive, industrial and IoT. Our ultra-low-power IPs for vision, audio, communications and connectivity include comprehensive DSP-based platforms for LTE/LTE-A/5G baseband processing in handsets, infrastructure and cellular IoT (NB-IoT and Cat-M1) enabled devices, advanced imaging and computer vision for any camera-enabled device, audio/voice/speech and ultra-low power always-on/sensing applications for multiple IoT markets. For artificial intelligence, we offer a family of AI processors capable of handling the complete gamut of neural network workloads, on-device. For connectivity, we offer the industry’s most widely adopted IPs for Bluetooth (low energy and dual mode) and Wi-Fi (Wi-Fi 4 (802.11n), Wi-Fi 5 (802.11ac) and Wi-Fi 6 (802.11ax) up to 4×4). Visit us at ceva-dsp.com and follow us on Twitter, YouTube, Facebook, LinkedIn and Instagram.

Forward Looking Statement

This press release contains forward-looking statements that involve risks and uncertainties, as well as assumptions that if they materialize or prove incorrect, could cause the results of CEVA to differ materially from those expressed or implied by such forward-looking statements and assumptions. Forward-looking statements include Mr. Wertheizer’s statements about CEVA’s licensing agreements forming the foundation for significant market share expansion and royalty revenue growth in the coming years, the elevated inventories in handsets to add to the usual seasonal weakness in near-term royalties, expectation of continued expansion at our non-handset and base station customers, along with a recovery in handsets in the later part of the year, as well as the belief that CEVA is on track to more than double its royalty revenue business in 2022. The risks, uncertainties and assumptions that could cause differing CEVA results include: the ability of the CEVA DSP cores and other technologies to continue to be strong growth drivers for us; our success in penetrating new markets, including in non-baseband markets, and maintaining our market position in existing markets; our ability to diversify the company’s royalty streams, the ability of products incorporating our technologies to achieve market acceptance, the speed and extent of the expansion of the 4G, 5G and LTE networks, the maturation of the IoT market, the effect of intense industry competition and consolidation, global chip market trends, the possibility that markets for CEVA’s technologies may not develop as expected or that products incorporating our technologies do not achieve market acceptance; our ability to timely and successfully develop and introduce new technologies; and general market conditions and other risks relating to our business, including, but not limited to, those that are described from time to time in our SEC filings. CEVA assumes no obligation to update any forward-looking statements or information, which speak as of their respective dates.

|

CEVA, INC. AND ITS SUBSIDIARIES |

||||

|

CONSOLIDATED STATEMENTS OF INCOME – U.S. GAAP |

||||

|

U.S. dollars in thousands, except per share data |

||||

|

Three months ended |

Year ended |

|||

|

December 31, |

December |

|||

|

2018 |

2017 |

2018 |

2017 |

|

|

Unaudited |

||||

|

Revenues: |

||||

|

Licensing and related revenues |

$ 10,539 |

$ 9,006 |

$ 40,446 |

$ 42,899 |

|

Royalties |

10,862 |

12,595 |

37,431 |

44,608 |

|

Total revenues |

21,401 |

21,601 |

77,877 |

87,507 |

|

Cost of revenues |

1,985 |

1,923 |

7,951 |

6,953 |

|

Gross profit |

19,416 |

19,678 |

69,926 |

80,554 |

|

Operating expenses: |

||||

|

Research and development, net |

11,999 |

9,972 |

47,755 |

40,385 |

|

Sales and marketing |

2,859 |

3,150 |

12,161 |

12,572 |

|

General and administrative |

2,161 |

3,100 |

10,354 |

10,488 |

|

Amortization of intangible assets |

225 |

309 |

901 |

1,236 |

|

Total operating expenses |

17,244 |

16,531 |

71,171 |

64,681 |

|

Operating income (loss) |

2,172 |

3,147 |

(1,245) |

15,873 |

|

Financial income, net |

883 |

879 |

3,418 |

3,026 |

|

Revaluation of investment in other company |

(870) |

(870) |

||

|

Income before taxes on income |

2,185 |

4,026 |

1,303 |

18,899 |

|

Income taxes (benefit) |

(118) |

863 |

729 |

1,871 |

|

Net income |

$2,303 |

$3,163 |

$574 |

$17,028 |

|

Basic net income per share |

$0.11 |

$0.14 |

$0.03 |

$0.78 |

|

Diluted net income per share |

$0.10 |

$0.14 |

$0.03 |

$0.75 |

|

Weighted-average number of Common Stock used in computation of net income per share (in thousands): |

||||

|

Basic |

21,863 |

22,017 |

22,034 |

21,771 |

|

Diluted |

22,197 |

22,801 |

22,503 |

22,561 |

|

Unaudited Reconciliation of GAAP to Non-GAAP Financial Measures |

|||||

|

U.S. Dollars in thousands, except per share amounts |

|||||

|

Three months ended |

Year ended |

||||

|

December 31 |

December |

||||

|

2018 |

2017 |

2018 |

2017 |

||

|

Unaudited |

|||||

|

GAAP net income |

$2,303 |

$3,163 |

$574 |

$17,028 |

|

|

Equity-based compensation expense included in cost of revenue |

108 |

129 |

588 |

459 |

|

|

Equity-based compensation expense included in research and development expenses |

1,267 |

1,005 |

5,141 |

3,839 |

|

|

Equity-based compensation expense included in sales and marketing expenses |

341 |

388 |

1,587 |

1,428 |

|

|

Equity-based compensation expense included in general and administrative expenses |

568 |

825 |

3,051 |

2,967 |

|

|

Income tax benefit related to equity-based compensation expenses |

(312) |

(71) |

(712) |

(339) |

|

|

Amortization of intangible assets related to RivieraWaves transaction and in 2018 NB-IoT technologies |

304 |

309 |

1,241 |

1,236 |

|

|

Revaluation of investment in other company, net of taxes |

670 |

670 |

|||

|

Non-GAAP net income |

$5,249 |

$5,748 |

$12,140 |

$26,618 |

|

|

GAAP weighted-average number of Common Stock used in computation of diluted net income per share (in thousands) |

22,197 |

22,801 |

22,503 |

22,561 |

|

|

Weighted-average number of shares related to outstanding stock-based awards (in thousands) |

404 |

228 |

388 |

283 |

|

|

Weighted-average number of Common Stock used in computation of diluted earnings per share, excluding the above (in thousands) |

22,601 |

23,029 |

22,891 |

22,844 |

|

|

GAAP diluted net income per share |

$0.10 |

$0.14 |

$0.03 |

$0.75 |

|

|

Equity-based compensation expense, net of taxes |

$0.09 |

$0.10 |

$0.42 |

$0.37 |

|

|

Amortization of intangible assets related to RivieraWaves transaction and in 2018 NB-IoT technologies |

$0.01 |

$0.01 |

$0.05 |

$0.05 |

|

|

Revaluation of investment in other company, net of taxes |

$0.03 |

$0.03 |

|||

|

Non-GAAP diluted net income per share |

$0.23 |

$0.25 |

$0.53 |

$1.17 |

|

|

CEVA, INC. AND ITS SUBSIDIARIES |

||

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

||

|

(U.S. Dollars in thousands) |

||

|

December 31, |

December 31, |

|

|

2018 |

2017 (*) |

|

|

Unaudited |

Unaudited |

|

|

ASSETS |

||

|

Current assets: |

||

|

Cash and cash equivalents |

$ 22,260 |

$ 21,739 |

|

Marketable securities and short term bank deposits |

123,608 |

117,096 |

|

Trade receivables |

9,971 |

14,480 |

|

Accrued revenues |

16,185 |

2,014 |

|

Prepaid expenses and other current assets |

5,264 |

3,747 |

|

Total current assets |

177,288 |

159,076 |

|

Long-term assets: |

||

|

Bank deposits |

21,864 |

44,518 |

|

Severance pay fund |

9,026 |

8,910 |

|

Deferred tax assets |

5,924 |

3,643 |

|

Property and equipment, net |

7,344 |

6,926 |

|

Goodwill |

46,612 |

46,612 |

|

Intangible assets, net |

2,700 |

1,742 |

|

Other long term assets |

6,505 |

5,385 |

|

Total assets |

$ 277,263 |

$ 276,812 |

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

||

|

Current liabilities: |

||

|

Trade payables |

$ 632 |

$ 392 |

|

Deferred revenues |

3,593 |

4,399 |

|

Accrued expenses and other payables |

17,527 |

18,004 |

|

Total current liabilities |

21,752 |

22,795 |

|

Long-term liabilities: |

||

|

Accrued severance pay |

9,632 |

9,347 |

|

Total liabilities |

31,384 |

32,142 |

|

Stockholders’ equity: |

||

|

Common stock: |

22 |

22 |

|

Additional paid in-capital |

223,250 |

217,417 |

|

Treasury stock |

(39,132) |

(26,056) |

|

Accumulated other comprehensive loss |

(1,114) |

(586) |

|

Retained earnings |

62,853 |

53,873 |

|

Total stockholders’ equity |

245,879 |

244,670 |

|

Total liabilities and stockholders’ equity |

$ 277,263 |

$ 276,812 |

|

(*) Derived from audited financial statements |

||

SOURCE CEVA, Inc.