MOUNTAIN VIEW, Calif., May 4, 2015 /PRNewswire/ — CEVA, Inc. (NASDAQ: CEVA), the leading licensor of DSP and IP platforms for cellular, multimedia and connectivity, today announced its financial results for the first quarter ended March 31, 2015.

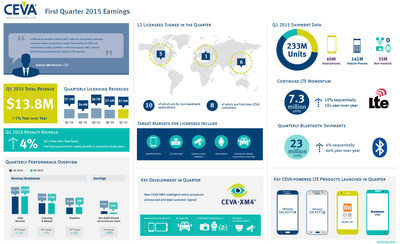

Total revenue for the first quarter of 2015 was $13.8 million, a 1% increase compared to $13.7 million reported for the first quarter of 2014, exceeding the Company’s guidance. First quarter 2015 licensing and related revenue was $7.8 million, 1% lower when compared to $7.9 million reported for the same quarter a year ago. Royalty revenue for the first quarter of 2015 was $6.0 million, an increase of 4% when compared to $5.8 million reported for the first quarter of 2014.

Gideon Wertheizer, Chief Executive Officer of CEVA, stated: “CEVA had an excellent start to 2015, with our first quarter revenues coming in above our guidance range. Demand for our DSP and connectivity product portfolios continues to grow, with a record twelve licensing agreements signed in the quarter. We also delivered year-over-year royalty revenue growth, driven primarily by LTE shipments. Overall, our results are encouraging and we remain confident in our growth prospects for the remainder of the year.”

U.S. GAAP net income for the first quarter of 2015 was $0.5 million, a 76% decrease from $2.0 million reported for the same period in 2014. U.S. GAAP diluted earnings per share for the first quarter of 2015 were $0.02, a decrease of 78% when compared to $0.09 for the first quarter of 2014.

Non-GAAP net income and diluted earnings per share for the first quarter of 2015 were $1.6 million and $0.08, respectively, representing a 51% and 50% decrease, respectively, over the $3.4 million and $0.16 reported for the first quarter of 2014. Non-GAAP net income and diluted earnings per share for the first quarter of 2015 excluded (a) equity-based compensation expense of $0.8 million, and (b) the impact of the amortization of acquired intangibles and other costs, net of tax, of $0.3 million associated with the acquisition of RivieraWaves. Non-GAAP net income and diluted earnings per share for the first quarter of 2014 excluded an aggregate equity-based compensation expense, net of taxes, of $1.4 million.

During the quarter, CEVA completed 12 new license agreements. Seven of the agreements were for CEVA DSP cores, platforms and software and five of the agreements were for CEVA connectivity IPs. Of the twelve agreements signed during the quarter, ten are for non-baseband applications, and eight are with first time customers for CEVA, which reinforces both the importance and success of the Company’s diversification strategy. Target applications for customer deployment are smartphones, LTE routers, Advanced Driver Assistance Systems (ADAS), surveillance cameras, wearables and storage systems. Geographically, five of the agreements signed were in the U.S, one was in Europe and six were in Asia.

Yaniv Arieli, Chief Financial Officer of CEVA, stated: “Our first quarter results reflect excellent licensing execution and continued growth in LTE smartphones enabled by our DSPs in the quarter, reaching an all-time high of more than seven million units shipped. During the quarter, we repurchased approximately 94,000 shares of our common stock for an aggregate consideration of approximately $1.9 million. At the end of the quarter, our cash balance, marketable securities and bank deposits totaled $128 million.”

CEVA Conference Call

On May 4, 2015, CEVA management will conduct a conference call at 8:30 a.m. Eastern Time to discuss the operating performance for the quarter.

The conference call will be available via the following dial in numbers:

- U.S. Participants: Dial 1-866-364-3869 (Access Code: CEVA)

- International Participants: Dial +1-412-902-4215 (Access Code: CEVA)

The conference call will also be available live via the Internet at the following link: http://www.videonewswire.com/event.asp?id=102027. Please go to the web site at least fifteen minutes prior to the call to register, download and install any necessary audio software.

For those who cannot access the live broadcast, a replay will be available by dialing +1-877-344-7529 or +1-412-317-0088 (access code: 10063393) from one hour after the end of the call until 9:00 a.m. (Eastern Time) on May 19, 2015. The replay will also be available at CEVA’s investor web site investors.ceva-ip.com.

About CEVA, Inc.

CEVA is the leading licensor of cellular, multimedia and connectivity technologies to semiconductor companies and OEMs serving the mobile, consumer, automotive and IoT markets. Our DSP IP portfolio includes comprehensive platforms for multimode 2G/3G/LTE/LTE-A baseband processing in terminals and infrastructure, computer vision and computational photography for any camera-enabled device, audio/voice/speech and ultra-low power always-on/sensing applications for multiple IoT markets. For connectivity, we offer the industry’s most widely adopted IPs for Bluetooth (Smart and Smart Ready), Wi-Fi (802.11 b/g/n/ac up to 4×4) and serial storage (SATA and SAS). One in every three phones sold worldwide is powered by CEVA, from many of the world’s leading OEMs including Samsung, Huawei, Xiaomi, Lenovo, HTC, LG, Coolpad, ZTE, Micromax and Meizu. Follow us on Twitter, YouTube and LinkedIn.

Forward Looking Statement

This press release contains forward-looking statements that involve risks and uncertainties, as well as assumptions that if they materialize or prove incorrect, could cause the results of CEVA to differ materially from those expressed or implied by such forward-looking statements and assumptions. Forward-looking statements include Mr. Wertheizer’s statement that CEVA remains confident in its growth prospects for the remainder of 2015, as well as Mr. Arieli’s statement about continued growth in LTE smartphones. The risks, uncertainties and assumptions include: the ability of the CEVA DSP cores and other technologies, including connectivity IPs, to continue to be strong growth drivers for us; our success in penetrating new markets and maintaining our market position in existing markets; the ability of products incorporating our technologies to achieve market acceptance, the speed and extent of the expansion of the 3G and LTE networks, the effect of intense industry competition and consolidation, global chip market trends, the possibility that markets for CEVA’s technologies may not develop as expected or that products incorporating our technologies do not achieve market acceptance; our ability to timely and successfully develop and introduce new technologies; and general market conditions and other risks relating to our business, including, but not limited to, those that are described from time to time in our SEC filings. CEVA assumes no obligation to update any forward-looking statements or information, which speak as of their respective dates.

|

CEVA, INC. AND ITS SUBSIDIARIES |

||

|

CONDENSED CONSOLIDATED STATEMENTS OF INCOME – U.S. GAAP |

||

|

U.S. dollars in thousands, except per share data |

||

|

Quarter ended |

||

|

March 31, |

||

|

2015 |

2014 |

|

|

Unaudited |

Unaudited |

|

|

Revenues: |

||

|

Licensing and related revenues |

$ 7,839 |

$ 7,906 |

|

Royalties |

5,995 |

5,768 |

|

Total revenues |

13,834 |

13,674 |

|

Cost of revenues |

1,185 |

1,112 |

|

Gross profit |

12,649 |

12,562 |

|

Operating expenses: |

||

|

Research and development, net |

7,363 |

5,996 |

|

Sales and marketing |

2,426 |

2,393 |

|

General and administrative |

1,972 |

2,040 |

|

Amortization of intangible assets |

325 |

|

|

Total operating expenses |

12,086 |

10,429 |

|

Operating income |

563 |

2,133 |

|

Financial income (loss), net |

(27) |

460 |

|

Income before taxes on income |

536 |

2,593 |

|

Income taxes |

50 |

608 |

|

Net income |

$ 486 |

$ 1,985 |

|

Basic and diluted net income per share |

$0.02 |

$0.09 |

|

Weighted-average shares used to compute net income per share (in thousands): |

||

|

Basic |

20,418 |

21,159 |

|

Diluted |

20,958 |

21,590 |

|

Unaudited Reconciliation of GAAP to Non-GAAP Financial Measures |

||

|

Quarter ended |

||

|

March 31, |

||

|

2015 |

2014 |

|

|

Unaudited |

Unaudited |

|

|

GAAP net income |

486 |

1,985 |

|

Equity-based compensation expense included in cost of revenues |

35 |

58 |

|

Equity-based compensation expense included in research and development expenses |

391 |

601 |

|

Equity-based compensation expense included in sales and marketing expenses |

79 |

302 |

|

Equity-based compensation expense included in general and administrative expenses |

344 |

552 |

|

Income tax benefit related to equity-based compensation expenses |

– |

(135) |

|

Costs associated with the RivieraWaves acquisition |

98 |

– |

|

Amortization of intangible assets related to RivieraWaves transaction, net of tax |

212 |

– |

|

Non-GAAP net income |

$ 1,645 |

$ 3,363 |

|

GAAP weighted-average number of Common Stock used in computation of diluted net income per share (in thousands) |

20,958 |

21,590 |

|

Weighted-average number of shares related to outstanding options and stock appreciation rights (in thousands) |

114 |

– |

|

Weighted-average number of Common Stock used in computation of diluted earnings per share, excluding the above (in thousands ) |

21,072 |

21,590 |

|

GAAP diluted earnings per share |

$ 0.02 |

$ 0.09 |

|

Equity-based compensation expense, net of taxes |

$ 0.04 |

$ 0.07 |

|

Costs associated with the RivieraWaves acquisition |

$ 0.01 |

– |

|

Amortization of intangible assets related to RivieraWaves transaction, net of tax |

$ 0.01 |

|

|

Non-GAAP diluted earnings per share |

$ 0.08 |

$ 0.16 |

|

CEVA, INC. AND ITS SUBSIDIARIES |

||

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

||

|

(U.S. Dollars in thousands) |

||

|

March 31, |

December 31, |

|

|

2015 |

2014 (*) |

|

|

Unaudited |

Unaudited |

|

|

ASSETS |

||

|

Current assets: |

||

|

Cash and cash equivalents |

$ 13,993 |

$ 16,166 |

|

Marketable securities and short term bank deposits |

74,941 |

85,277 |

|

Trade receivables, net |

11,376 |

8,347 |

|

Deferred tax assets |

1,943 |

1,868 |

|

Prepaid expenses and other current assets |

5,393 |

3,982 |

|

Total current assets |

107,646 |

115,640 |

|

Long-term assets: |

||

|

Long term bank deposits |

39,176 |

28,424 |

|

Severance pay fund |

7,265 |

7,011 |

|

Deferred tax assets |

734 |

399 |

|

Property and equipment, net |

2,727 |

2,605 |

|

Goodwill |

46,612 |

46,612 |

|

Investment in other companies |

1,806 |

1,806 |

|

Other intangible assets |

5,187 |

5,512 |

|

Total assets |

$ 211,153 |

$ 208,009 |

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

||

|

Current liabilities: |

||

|

Trade payables |

$ 1,276 |

$ 864 |

|

Deferred revenues |

2,078 |

1,681 |

|

Accrued expenses and other payables |

14,984 |

16,711 |

|

Taxes payable |

775 |

739 |

|

Deferred tax liabilities |

443 |

464 |

|

Total current liabilities |

19,556 |

20,459 |

|

Long-term liabilities: |

||

|

Accrued severance pay |

7,551 |

7,096 |

|

Deferred tax liabilities |

1,302 |

1,405 |

|

Total liabilities |

28,409 |

28,960 |

|

Stockholders’ equity: |

||

|

Common stock: |

21 |

20 |

|

Additional paid in-capital |

210,275 |

209,426 |

|

Treasury stock |

(49,319) |

(54,708) |

|

Accumulated other comprehensive loss |

(311) |

(436) |

|

Retained earnings |

22,078 |

24,747 |

|

Total stockholders’ equity |

182,744 |

179,049 |

|

Total liabilities and stockholders’ equity |

$ 211,153 |

$ 208,009 |

|

(*) Derived from audited financial statements |

Info – http://photos.prnewswire.com/prnh/20150503/213446-INFO

Logo – http://photos.prnewswire.com/prnh/20120808/SF53702LOGO

SOURCE CEVA, Inc.