After a stellar 2015 for smartphone sales in China, all eyes are turning to India for the next few years. The country has just passed 1 billion cellular subscribers, yet less than 125 million are using smartphones today. In fact, India is slated to overtake the United States in 2016 to become the world’s second-largest market for smartphones after China.

Even moreso than China, India is particularly price-conscious when it comes to both the cost of smartphones and the data plans required to access the internet over the cellular networks. According to The Associated Chambers of Commerce of India, the affordable smartphone segment which includes handsets with in the price range of Rs 4,000 to Rs 10,000 ($30 – $150) accounts for 78% of all smartphone sales. And with operators set to battle it out to attract more subscribers onto their 3G and LTE networks, the mobile revolution in India is finally getting underway.

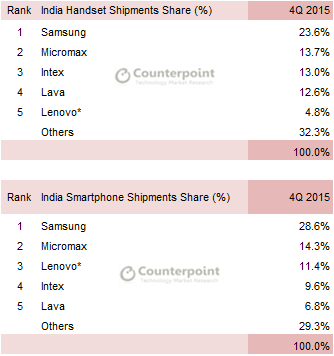

Similar to China, dozens of homegrown Indian smartphone OEMs have emerged, successfully competing head-to-head with global OEMs such as Samsung, Lenovo, Xiaomi and Huawei. According to IDC, more than one third of all smartphones sold in India during 2015 came from local OEMs. Three brands – Micromax, Intex and Lava – accounted for 30% of Indian smartphones sold in Q4 15 as stated in Counterpoint Research’s latest Indian handset market report.

Counterpoint Research Indian handset and smartphone market share data for Q4 15

So what kind of 3G and LTE smartphones can you buy today that fall into the “affordable” bracket in India? A quick look on Flipkart, the online portal responsible for more than half of online smartphone sales in India in 2015 shows a huge range of options at every price point within this price segment.

Some of the 3G smartphones available on Flipkart, India’s biggest online smartphone retailer

For starters, $25 will get you a Kenxinda K528 Dual-SIM 3G smartphone with 3.5 inch display. For $35, you can get the Aqua V5, from Intex, one of India’s strongest local smartphone brands. For $50, you can get a much wider range of options including the Intel Cloud 3G and Micromax Bolt S300, which comes with 512mb of RAM and a 4 inch touch screen. For $65, again the options are huge but some of the standout phones in this price bracket are the Huawei Honor Bee and the 5 inch display Lava Iris Atom 3.

LTE smartphones ranging from $75 to $135 in India

Looking at the rapidly growing LTE smartphone segment, the pricing today on Flipkart begins at about $75, which is less than half the average selling price of smartphones in India during 2015. This incredible statistic, combined with Counterpoint Research’s claim that more than one in two smartphones shipped during Q4 15 were LTE-enabled, shows that the Indian LTE smartphone segment is now priced to attract mass market adoption, whereas up until now it was primarily restricted to those that could afford mid and high-end smartphones. And the smartphones that start at this price point are exceptional value for money.

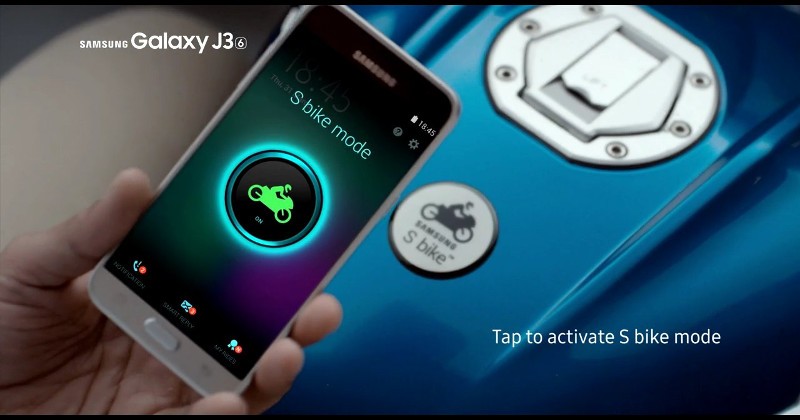

Some of the options include the Intex Cloud 4G Smart, and the Lava A88. Another online retailer, Snapdeal is selling the XOLO Era 4G for under $75 and the InFocus Bingo 21 for just over $80. And finally, if you have a little more to spend ($135), Samsung have just launched the Galaxy J3, a 5 inch quad-core smartphone with Super Amoled Display and something called “S Bike Mode” meant to help ensure minimum distraction while riding a two-wheeler .

The CEVA-powered Samsung Galaxy J3 offers a special “S bike mode” for increased safety on two wheels

All in all, despite the underwhelming growth expectations for the worldwide smartphone market (Gartner predict only 7% growth in smartphone units in 2016) the next few years are poised to be hugely exciting for the smartphone industry in India and other emerging markets where smartphone penetration is still very low. Nevertheless, the low average selling price for the majority of smartphone sales into emerging markets mean that profits will be hard to come by for the component suppliers. In the case of CEVA, however, a price-driven smartphone market is exactly what we’ve been waiting for and our customers are expected to gain market share as a result. A clear indicator that this is already underway is that all of the 3G and LTE smartphones that I referenced in this piece are powered by CEVA DSP technology.

You might also like

More from Communication

5G Based LEO satellites will Truly Grow IoT Adoption Worldwide

When most of us think about widespread technology adoption we have a pronounced urban bias. Tech growth pitches around 5G …

5G Evolution, the road to realizing the full extent of 5G Technology Revolution

5G technology is widely considered a revolutionary introduction in the field of telecommunications and connectivity. The revolutionary aspects of 5G …

Millimeter-Wave Radar Expands the Operational Design Domain for Autonomous Vehicles

It is becoming clear that further advances in autonomous vehicles will depend to a significant degree on advances in sensors. …